Where next for market research?

In July 2018, news broke that the MRIA – the industry association for market research in Canada – was shutting down. The immediate cause was crushing debt, but in the longer term its falling membership illustrated how the research industry is evolving: custom surveys and focus groups are no longer an essential business tool for many organisations that have numerous other sources of insights available to them. So where does the future of the research industry lie, and what must we do to remain relevant? The below piece was written for ESOMAR, a global research industry association, and a version of it also appeared on the GreenBook blog.

The brief summer pause in research conferences, webinars and events is a good time to reflect on the major themes being discussed and what they suggest for the future of market research. As in years past, two clear themes arise.

First, how much time is spent discussing how to do research better. Second, the extent to which vendors dominate these discussions: a quick look through conference agendas this year suggests about twice as many vendors as clients spoke at them. Neither theme is surprising. As with any industry there are always ways to improve what we do; and vendors, being in the business of selling research, are often more focused on where it progresses as a profession.

There is a third theme from these discussions, but it’s worth pausing briefly to consider the nature of market research.

Conventional research has two parts: data, and meaning. When a client commissions a project, the vendor collects some data, then analyses it to extract meaning. The data may come from a survey, focus groups, biometrics or numerous other sources. It can be numerical, with tables and TURF analysis; it can be a transcript of an interview, or it can just be a single answer to a particular question. A large part of researchers’ expertise is knowing what data is required for a specific objective and designing the ideal way to collect it. But that’s just the first part of any research study.

The second part is about finding meaning. It starts with the data – the survey responses, the focus group transcripts or something else – and produces insights and conclusions. The process isn’t always clear; everyone broadly understands how to ‘do’ a survey, but it’s tough to explain exactly how to turn 400 pages of data tables into concise conclusions, or translate 30 pages of focus group notes into three clear business implications. Good researchers do it very well, others… not so much. However it’s done, though, without the meaning a project isn’t research – it’s just a collection of data.

More importantly, for clients the meaning is the project, and data is just a by-product. Every research study stems from a business challenge – what product line to develop, how to reach an audience, which strategy is best – and the research only exists to provide solutions to that challenge. Nobody starts a project stating that “we need 400 pages of data tables”; instead, a successful research study is one that generates business outcomes – actionable findings, clear direction or a compelling marketing strategy. For clients, research is about the meaning, and better research means better meaning and better outcomes.

With this in mind, the third clear theme from industry discussions around improving research is the extent to which they’re dominated by vendors talking about data collection. Across conferences, webinars and other forums, vendors seem obsessed by the future of collecting data, how to gather “correct” data, and new and supposedly better types of data. It’s mostly vendors because clients don’t care: give a client a choice between a new data source they can’t interpret and better outcomes from established data sources, and they’ll choose the latter 9 times out of 10.

This rift between clients’ concerns and industry discussion is clearly troubling, but it also sells short what research is.

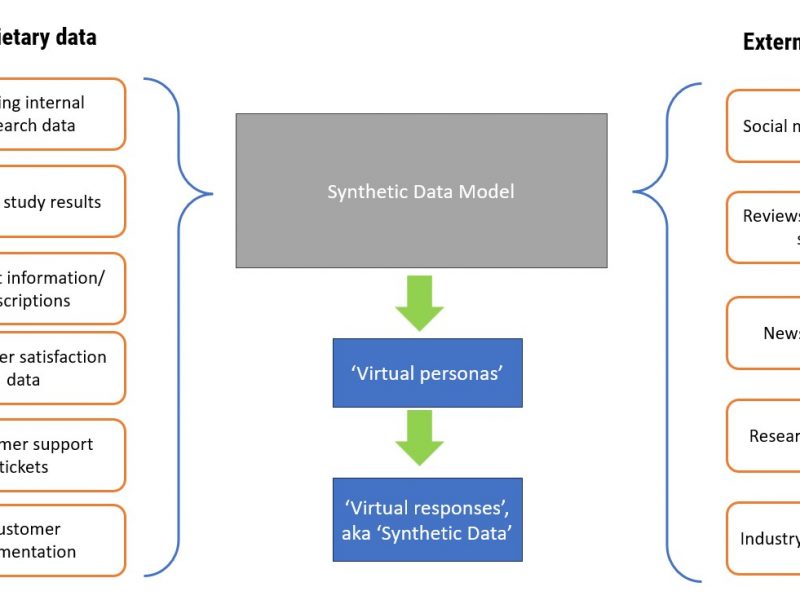

20 years ago, research was based almost entirely on telephone or in-person interviews, and data collection was a huge part of any project. Now, data is a commodity. Clients are drowning in website traffic, in-store footfall and ad campaign metrics. For those who need to collect more, self-serve tools such as Zappi, Google Surveys and iTracks are cheap and easy to use. Research vendors’ ability to collect data is no longer a differentiating factor, and collecting yet more data isn’t necessarily providing clients with a solution they want.

Instead, as researchers, we need to really understand our expertise and what we bring to businesses. We’re not just data collectors; researchers’ value is in making sense of data – extracting meaning from diverse datasets and turning it into business outcomes. We know consumers, we understand behaviours and we can track trends; but most importantly we can turn data into insightful outputs and clear recommendations for non-researchers to use. It’s a unique skillset, increasingly valuable as clients grapple with a deluge of data, and it’s what we should be focusing on as an industry.

“We can collect better data” is the research slogan of the past. “We can turn this data into something meaningful” is what clients have always looked for; as we consider where the industry goes from here, it’s also the research slogan for the future.

If you found this interesting and want to talk further about how research remains relevant, and how we at Fuse help clients get more actionable insight from the data and research strategies, please get in touch!